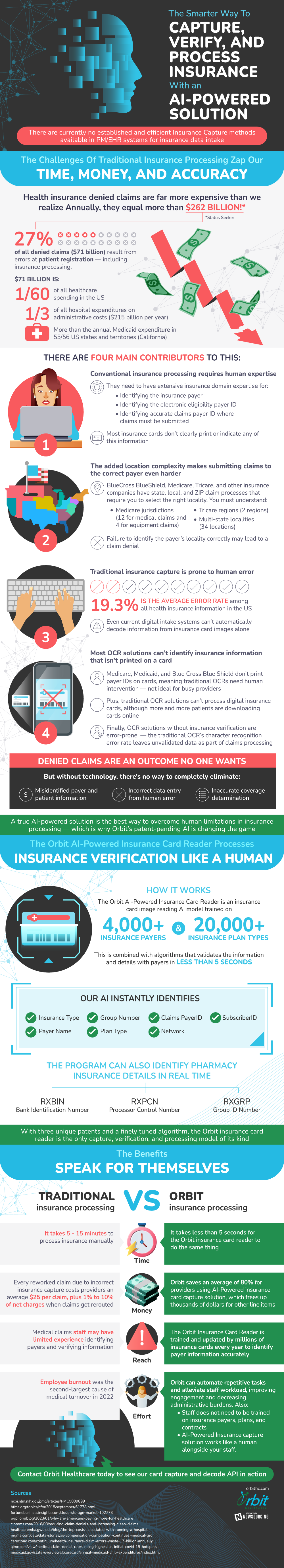

The Challenges Of Traditional Insurance Processing Zap Our Time, Money, And Accuracy

- Health insurance denied claims are far more expensive than we realize Annually, they equal more than $262 billion!* *Status Seeker

- 27% of all denied claims ($71 billion) result from errors at patient registration — including insurance processing

- $71 billion is:

- 1/60 of all healthcare spending in the US

- 1/3 of all hospital expenditures on administrative costs ($215 billion per year)

- More than the annual Medicaid expenditure in 55/56 US states and territories (California)

- There are four main contributors to this:

- Conventional insurance processing requires human experts

- They need to have expensive insurance domain expertise for:

- Identifying the insurance payer

- Identifying the electronic eligibility payer ID

- Identifying accurate claims payer ID where claims must be submitted

- Most insurance cards don’t clearly print or indicate any of this information

- The added location complexity makes submitting claims to the correct payer even harder

- BlueCross BlueShield, Medicare, Tricare, and other insurance companies have state, local, and ZIP claim processes that require you to select the right locality

- You must understand:

- Medicare jurisdictions (12 for medical claims and 4 for equipment claims)

- Tricare regions (2 regions)

- Multi-state localities (34 locations)

- Failure to identify the payer’s locality correctly may lead to a claim denial.

- Traditional insurance capture is prone to human error

- 3% is the average error rate among all health insurance information in the US

- Even current digital intake systems can’t automatically decode information from insurance card images alone

- Most OCR solutions can’t identify insurance information that isn’t printed on a card

- Medicare, Medicaid, and Blue Cross Blue Shield don’t print payer IDs on cards, meaning traditional OCRs need human intervention — not ideal for busy providers

- Plus, traditional OCR solutions can’t process digital insurance cards, although more and more patients are downloading cards online

- Finally, OCR solutions without insurance verification are error-prone

- The traditional OCR’s character recognition error rate leaves unvalidated data as part of claims processing

- Denied claims are an outcome no one wants

- But without technology, there’s no way to completely eliminate:

- Misidentified payer and patient information

- Incorrect data entry from human error

- Inaccurate coverage determination

A true AI-powered OCR solution is the best way to overcome human limitations in insurance processing — which is why Orbit’s patent-pending AI is changing the game

The Orbit AI-Powered Insurance Card Reader Decodes Payers, Records Plans, And Processes Insurance Verification Like A Human

- The Orbit AI-Powered Insurance Card Reader is an insurance card image reading AI model trained on 4,000+ insurance payers and 20,000+ insurance plan types

- This is combined with algorithms that validate the information and verify details with payers in less than 5 seconds

- Our AI instantly identifies:

- Insurance Type

- Payer Name

- Claims PayerID

- Plan Type

- SubscriberID

- Group Number

- Network

- The program can identify pharmacy insurance details in real time

- RXBIN: Bank Identification Number

- RXPCN: Processor Control Number

- RXGRP: Group ID Number

With three unique patents and a finely tuned algorithm, the Orbit insurance card reader is the only capture, verification, and processing model of its kind

And The Benefits Speak For Themselves

- Time

- It takes 5 - 15 minutes to process insurance manually

- It takes less than 5 seconds for the Orbit insurance card reader to do the same thing

- Money

- Every reworked claim due to incorrect insurance capture costs providers an average $25 per claim, plus 1% to 10% of net charges when claims get rerouted

- Orbit saves an average of 80% for providers using AI-Powered insurance card capture solution, which frees up thousands of dollars for other line items

- Reach

- Medical claims staff may have limited experience identifying payers and verifying information

- The Orbit Insurance Card Reader is trained and updated by millions of insurance cards every year.

- Effort

- Employee burnout was the second-largest cause of medical turnover in 2022

- With Orbit, you can automate repetitive tasks and alleviate staff workload, improving engagement and decreasing administrative burdens

- Staff does not need to be trained on insurance payers, plans, and contracts

- AI-Powered Insurance capture solution works like a human alongside your staff

Contact Orbit Healthcare today to see our card capture and decode API in action.

Sources

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5009899/

https://www.carecloud.com/continuum/health-insurance-claim-errors-waste-17-billion-annually/

https://www.hfma.org/topics/hfm/2018/september/61778.html

https://www.ajmc.com/view/medical-claim-denial-rates-rising-highest-in-initial-covid-19-hotspots

https://www.mgma.com/data/data-stories/as-compensation-competition-continues,-medical-gro

https://www.ciproms.com/2016/08/reducing-claim-denials-and-increasing-clean-claims/

https://www.pgpf.org/blog/2023/01/why-are-americans-paying-more-for-healthcare

https://healthcaremba.gwu.edu/blog/the-top-costs-associated-with-running-a-hospital/

https://www.medicaid.gov/state-overviews/scorecard/annual-medicaid-chip-expenditures/index.html